Greenhouse gas emissions are at record levels and showing little sign of slowing. The global average temperature during the last decade was the highest on record compared to pre-industrial levels, as reported by three global agencies, and the trend is expected to continue.

World leaders and citizen groups are regularly gathering at climate change meetings and demonstrations around the world to voice their concerns about the deleterious effects of global warming and to emphasize the urgency of creating robust and realistic schemes to meet Paris reduction targets.

The ultimate goal is aspirational: net-zero by 2050. By net zero, carbon neutrality is implied, namely a post-carbon economy with a net zero carbon footprint, achieved by harmonizing carbon emissions with carbon removal.

Climate action groups and youth movements are beginning to experience some reasonable successes in focusing the attention of governments, financial stakeholders, and civil society to the existential challenges of climate change and the collective benefits of well-planned, speedy action. The zeitgeist seems right for achieving a net zero world.

Significantly, Mark Carney, economist and banker, former Governor of the Bank of Canada and Bank of England and now Special Envoy on Climate at the United Nations, considered as one of the world’s foremost leader’s championing climate change financing and policy, has recently stepped up to the plate with many world leaders to take action in dealing with the perceived crisis. He has been inspirational in formulating legislation and monetary policy for governments and businesses to accept and reconcile the effects of global warming and commit to the goal of a net-zero world by 2050.

His appointment to the United Nations, which starts around April 2020, and his commitment and determination to resolve climate change issues and plan climate finance solutions provides a great chance to influence and expedite ideas for a concerned global community.

It’s an ambitious mission as the economic growth of many countries is reliant on the continued production of fossil fuels to power industries, buildings and homes, and run transportation systems. As the key to success in this energy revolution has a strong economic component, it is crucial to de-risk the effects on the economy of implementing a gradual diversification of energy systems from ones based on non-renewable fossil fuels instead to those founded by renewable solar and wind energy over the next three decades.

This can be achieved by making financial policy a centerpiece for governments, businesses, and partnerships, in striving to achieve a net-zero economy. A challenge in realizing these goals is comprehensive transparency by all climate stakeholders on climate change, risk management, and investment to help companies deal with the financial stress on profits, investment, supply and demand, all associated with the perceived disruptive effects of the envisioned transition of the global energy infrastructure.

Any analysis of the risks involved to achieve net-zero emissions will involve stress testing of the financial sector to define whether the damage imposed by the change can be managed on a country-to-country basis without major economic disruption to the government, industry, and the private sector, while protecting the health and well-being of civil society and the environment.

Meanwhile, some of the world’s largest financial institutions (i.e., depository: banks, building societies, credit unions, trust, mortgage and loan companies; contractual: insurance companies and pension funds; investment: banks, underwriters and brokerage firms) are seeking to reduce their risk by divesting their investments in fossil fuel industries and aligning their loan portfolios in support of companies that are backing the transition to a net-zero industrial ecosystem.

The role of the financial institutions to provide finance for research and development of alternatives to fossil fuels is also key to achieving the targets set for a net-zero economy. Objectives of these institutions should be to develop alternatives that are competitive or even cheaper than fossil fuels. Then, users of fossils fuels will likely be encouraged to move away from fossil fuels instead of being compelled to move away from their use. An injection of significant institutional funding to achieve net zero will help the transition although targets for research and development spending set out in the Paris agreement are apparently insufficient. Financial institutions could be backing the research and development needed for a net-zero economy, particularly if they are divesting their investments in fossil fuel companies.

As illustrative of this trend, some of the world’s principal financial institutions with more than $2 trillion in assets have committed to develop eco-friendly investment portfolios by 2050. In addition, undertakings to reduce emissions have been made by major companies with aggregate market capitalization of more than $2.3 trillion. Also, around 33% of the global banking sector have committed to follow the Paris agreement with their investment portfolios.

A net-zero world is an incredibly ambitious vision, especially at a moment when oil prices are low and impacting the fossil fuel sector of the economy. This problem is exacerbated by some of the largest greenhouse gas emitters trying to maintain growth of their industries while reducing emissions, whereas others are weakening their climate commitments to boost economic growth. To avoid a climate catastrophe and meet Paris emission reduction targets, it will be necessary to leave a good proportion of the remaining supply of fossil carbon in the ground with a smart approach to protect investor’s economic returns.

It is clearly a balancing act of unprecedented proportions to reduce greenhouse gas emissions while not bringing non-renewable energy companies and their employees to poverty.

If not checked, an increase in greenhouse gas emissions may result in health and poverty issues related to the effects of global warming. So, the costs of financing this sector is also an issue that needs to be assessed. What will influence the health of people more: climate change or poverty?

Nevertheless, the climate finance debate is anticipated to motivate governments, business leaders, and civil society as well as energize climate youth movements to face the challenges of a significant readjustment of the financial market that will enable the gradual shift from fossil to non-fossil energy.

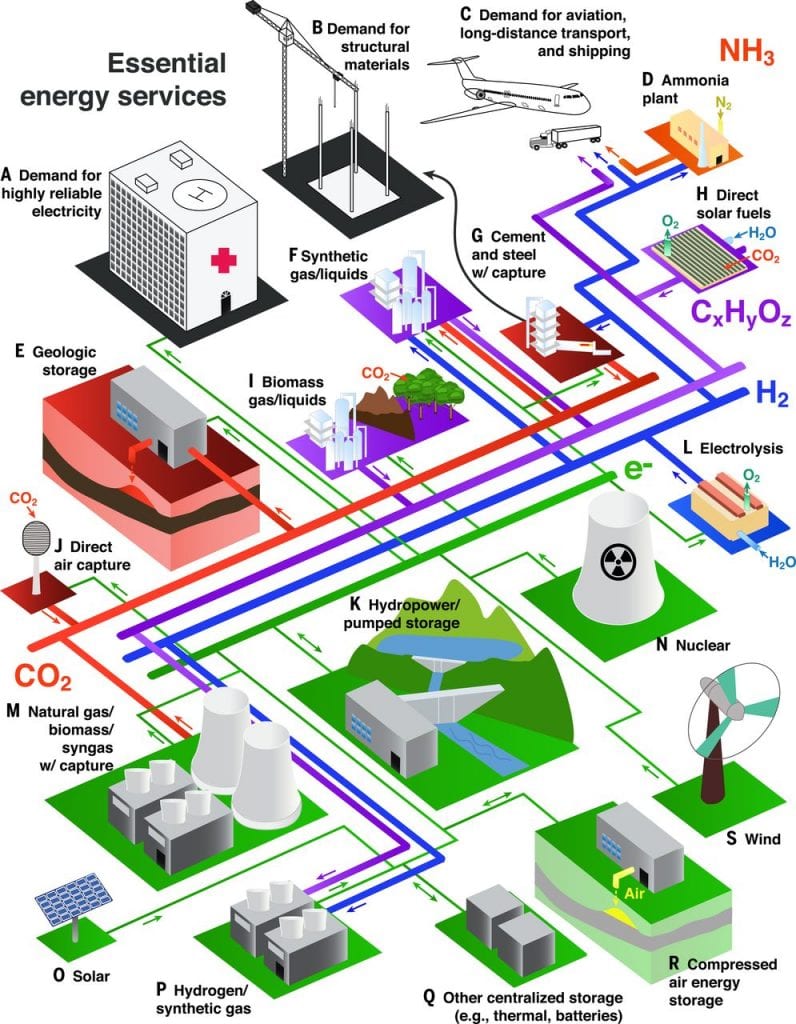

A recent report described what it would take technologically to create a net-zero-emissions energy infrastructure. It was proposed that known clean technologies, creatively integrated into essential energy systems and energy intensive industries, could enable a net-zero ecosystem, Figure 1.

The viability of this transition from non-renewable to renewable technologies, however, will be contingent on the reliable provision of vast amounts of low-cost renewable electricity; trustworthy grid balance of variable electricity generation, demand, and storage; electrification of energy intensive materials and manufacturing processes like steel, cement, chemicals, and petrochemicals; as well as transportation systems amenable to electrification. Large-scale, long-distance cargo ships, trucks, and passenger planes that cannot easily be electrified can be powered by carbon neutral fuels made by capturing and recycling carbon dioxide chemically or biologically.

One strategy aimed at decarbonisation of stubborn emissions is to centralize, unite, develop, and deploy candidate renewable energy technologies as depicted in Figure 1. This vision of integration of essential energy and industry operations could enhance the economics and efficiency of costly assets, facilitate cooperation of stakeholders, simplify the essential knowledge base required by policy makers, regulators, and legislators and minimize risk to investors to enable dependable and economically responsible provision of these net-zero services.

The economic and technological challenges of transitioning to a net-zero energy world are substantial. It remains to be demonstrated by continued research and development, scaling, and deployment of candidate clean technologies, which will prove to be most efficient, reliable, and cost-effective in future net-zero emission energy systems.

Written by Geoffery Ozin

Solar Fuels Group, University of Toronto, Toronto, Ontario, Canada, Email: [email protected], Web sites: www.nanowizard.info, www.solarfuels.utoronto.ca, www.artnanoinnovations.com

Acknowledgements – Insightful feedback from Bob Davies and Erik Haites who appraised the content of this article is deeply appreciated.