Have you ever felt overwhelmed with too many choices to the point of not even knowing where to start?

This is where recommendation systems come in. Due to the success of recommendations offered by high-profile companies such as Netflix and Amazon, consumers have come to rely on recommendations to help them make relatively low-risk choices. But for more consequential decisions like purchasing insurance, recommendation systems have little to nothing to say. Quality recommendations are especially needed here because insurance products frequently have a variety of options and a bewildering vocabulary that may even confuse seasoned consumers, let alone first-time buyers.

In comparison to typical industries that use recommender systems, the insurance industry is relatively unique. There is a very small number of possible products to choose from, but each is highly complex, which can make the purchasing process stressful. There are many factors to consider when purchasing a product, and consumers want an easy buying experience.

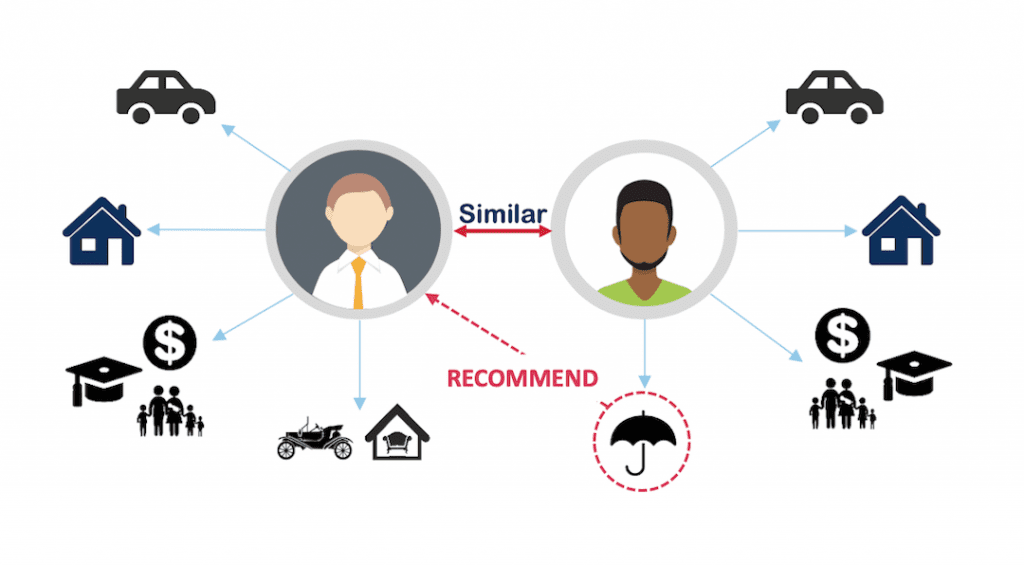

The goal is to give customers personalized recommendations based on what similar people with similar portfolios have in order to make sure they are adequately covered for their needs.

To address this need, a team of data scientists at American Family Insurance have created a recommender system that uses customer characteristics in addition to customer product portfolio data. Since the number of possible recommendable insurance products is relatively small compared to other domains, they chose to use Bayesian networks (BN) for modeling their systems. Their approach also employed deep learning to provide recommendations to “prospects” (i.e., potential customers), where only external marketing data is available at the time of prediction.

“If your domain is similar — small, highly complex, not fun, and with many constraints — you might be interested in how we choose to create a recommender system to meet the needs of our customers,” the authors stated.

The recommender system proactively brings customized coverage options to the attention of insurance agents so that customers are adequately covered. They proposed, implemented, and deployed a general-purpose BN-based recommendation system framework and methodology that has several advantages, including dealing gracefully with missing values —very relevant for recommender systems where customer information is scarce or not consistently populated — and faster training (structure discovery) and inference with respect to other approaches. Their method is scalable both for training and inference and can be easily implemented in a distributed fashion.

They also created a prospect’s recommender system based solely on external data. The system is trained using data from their customer base but it can be viewed as a “universal recommender” system that can recommend insurance products for almost every household in the U.S. This system could be useful for marketing, new customer acquisition, and resource planning.

Article written by Maleeha Qazi, Kaya Tollas, Teja Kanchinadam, Joseph Bockhorst, and Glenn Fung

Reference: Maleeha Qazi et al. ‘Designing and deploying insurance recommender systems using machine learning,’ WIREs Data Mining and Knowledge Discovery (2020). DOI: 10.1002/widm.1363